Breadcrumb

- California Offshore Winds

- Domestic Supply Chain

Domestic Supply Chain

- What is the purpose of developing a domestic supply chain for offshore wind energy?

The goal to install 30 gigawatts (GW) of offshore wind by 2030 set by the Biden administration highlights the need for a domestic supply chain. This supply chain is crucial for sustainable growth, fostering local workforce development, and promoting energy and environmental justice. Developing a domestic supply chain aims to reduce dependence on international sources, streamline project timelines, and ensure the industry's resilience against global supply chain disruptions. However, the development of an entirely new supply chain does not come without challenges.

- What would a domestic supply chain look like for offshore wind energy?

In order to establish an effective domestic supply chain, numerous facilities, vessels, and integration ports must be developed. These investments would cover ports, specialized vessels, and manufacturing facilities. These infrastructure investments would likely take 6 to 9 years to develop

- What are the main barriers to developing this supply chain and what steps can be taken to address these concerns?

Key challenges include investment risks due to uncertainties in project developments, such as permitting delays or legal challenges, and the high upfront costs associated with constructing new manufacturing facilities, ports, and vessels. Additionally, there's a pressing need for a specialized manufacturing workforce to support the industry's growth. Overcoming these barriers is essential to secure financing for new supply chain facilities and to meet the burgeoning demand for offshore wind energy components and installation services.

The NREL report outlines a multi-tiered action plan, categorized into short-, medium-, and long-term goals, to cultivate a robust, resilient, and sustainable offshore wind energy supply chain. [1] Some of the immediate actions include forming working groups for regional supply chain development, identifying strategic locations for new facilities, and establishing curriculum and funding for workforce training centers. The medium-term actions focus on constructing essential supply chain infrastructure, while long-term actions aim to maintain and upgrade key infrastructure to adapt to evolving technologies and expand the supply chain to new regions.

- What investments are necessary for developing the supply chain?

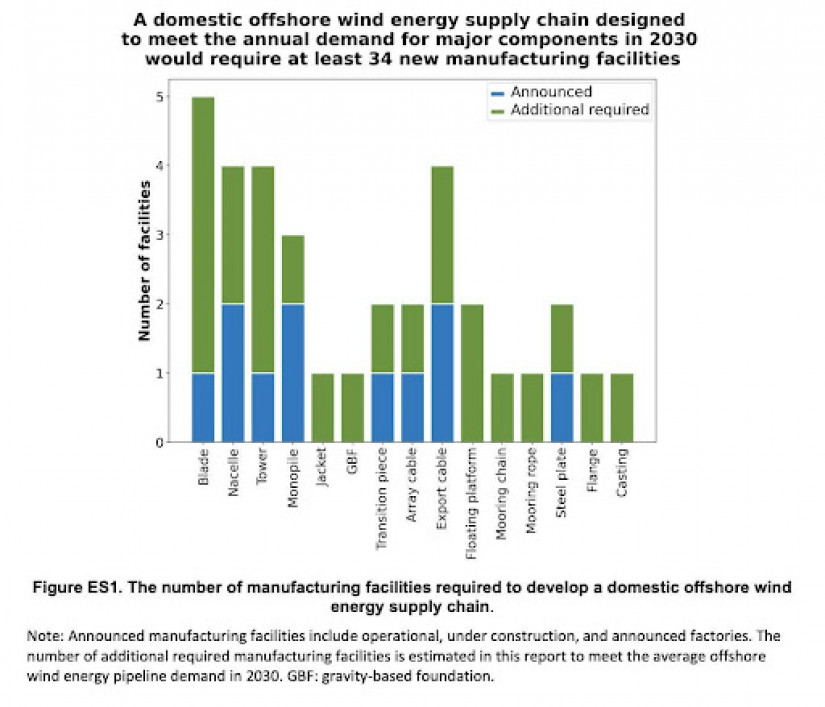

Significant investments are required in major component manufacturing facilities, ports, and vessels. A scenario presented in a 2023 NREL report suggests that to support an annual deployment rate of 4-6 GW—leading to 110 GW by 2050—requires a considerable investment in the domestic supply chain infrastructure. [1] This includes the development of at least 34 new manufacturing facilities for critical offshore wind components, alongside substantial upgrades at manufacturing ports, establishment of marshaling and integration ports, and procurement of specialized installation vessels.

NREL predicts that if the West Coast deploys 25 GW of offshore wind energy by 2045 that it will require 4 staging and integration ports in California, 8 operations and maintenance ports in California, 9 manufacturing and fabrication sites in California (if there is a domestic supply chain) and 7 manufacturing and fabrication sites in Oregon and Washington.[2] The total investment would be $15.3 billion with a U.S. supply chain and $4.4 billion without a U.S. supply chain. [2] One calculation suggests that $5 billion of investment in California could net the ability to deploy $125 billion of floating offshore wind projects. [2]

- How will the supply chain impact local communities and the workforce?

A domestic offshore wind energy supply chain is expected to generate a wide array of economic and workforce development across the United States, not just in coastal regions with active offshore wind programs. NREL emphasizes the potential for job creation within major manufacturing facilities and through the broader network of suppliers required to support these facilities; “The domestic supply chain scenario we discuss in this report includes direct jobs within the 34 major manufacturing facilities. We also estimate the opportunity space for direct and indirect supplier jobs producing subassemblies, parts, and materials for the major manufacturing facilities.”[1]

NREL underscores the importance of incorporating equity and justice into supply chain development, highlighting the need for meaningful engagement with local communities and ensuring that the benefits of offshore wind development are distributed equitably. In the past, areas near port development have felt the majority of the burdens rather than the benefits with exposure to pollutants and toxins from port activities.

[1] Shields, M. et al. (2023). A Supply Chain Road Map for Offshore Wind Energy in the United

States - https://www.nrel.gov/docs/fy23osti/84710.pdf

[2] Shields, M. et al. (2023) The Impacts of Developing a Port Network for Floating Offshore Wind Energy on the West Coast of the United States, https://www.nrel.gov/docs/fy23osti/86864.pdf